Finding the right funding can transform your business journey. For Black women entrepreneurs, specialized grants offer critical financial support while addressing historical funding disparities. These opportunities provide not just capital, but often include mentorship, networking, and business development resources.

In this comprehensive guide, you’ll discover:

Current grant opportunities specifically designed for Black women business owners

Step-by-step application strategies to maximize your chances of success

Expert insights on navigating the grant landscape in 2025

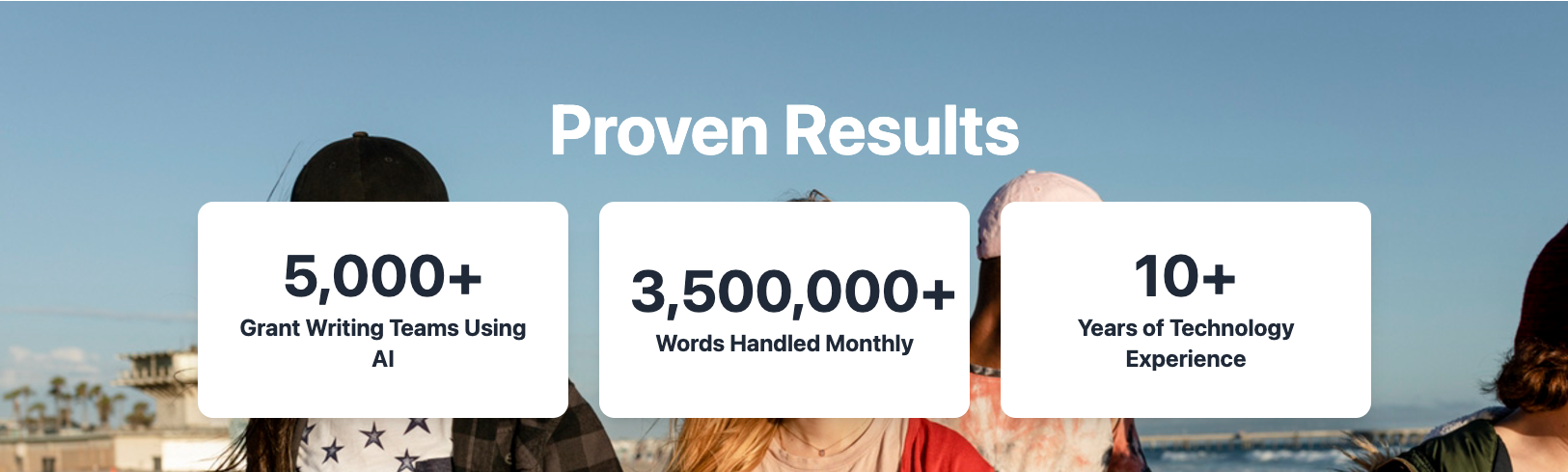

PS., Teams using AI-powered grant writing tools like Grantboost can handle their entire monthly grant workload in the time it used to take to complete just one application. This tool is making grant writing faster and easier for youth sports programs like yours.

Stick around to learn more! 😉

For individuals and teams looking to secure more funding with less effort. Streamline your grant-writing process, stay organized, and achieve better results with proven templates and AI-driven support.

| Grant Name | Funding Amount | Eligibility | Application Deadline |

|---|---|---|---|

| HerRise Microgrant | $1,000 monthly | Women-owned businesses, < $1M revenue | Last day of each month |

| Wish Local Empowerment Program | $500-$2,000 | Black business owners with storefronts, < 20 employees | Rolling basis |

| Amber Grant Foundation | $10,000 monthly; $25,000 yearly | Women-owned businesses across all industries | Monthly review |

| Pathway to Opportunity | Up to $5,000 | Black-owned U.S. businesses | June 9, 2025 |

| Verizon Small Business Digital Ready Grant | $10,000 | Active users of Verizon’s Small Business Digital Ready program | June 30, 2025 |

| Galaxy Grant | $3,500 | Women and people of color, U.S. residents | June 30, 2025 |

| The Freed Fellowship | $500 monthly + coaching | Small business owners, underrepresented entrepreneurs | Monthly rolling selection |

| Illuminations Grant | $10,000 | Black transgender women in visual arts | July 2, 2025 |

| NASE Growth Grants | Up to $4,000 | NASE members in good standing | Rolling monthly |

| Comcast RISE Investment Fund | $5,000 + resources | Small businesses in selected cities | Application closed for 2025 |

| Tory Burch Foundation Fellows Program | $5,000 + 0% loans | Women entrepreneurs with at least 51% ownership, $75,000+ revenue | Sept 24 - Nov 1, 2025 |

| NBMBAA Scale-Up Pitch Challenge | $50,000 (1st) - $7,500 (3rd) | Black founders with equal ownership and NBMBAA membership | August 4, 2025 |

| National Black Business Pitch | Up to $10,000 | Black business owners | June 9, 2025 |

| Glossier Grant Program | $50,000; $100,000 Alumni | Black-owned beauty brands | 2025 cycle TBD |

| Brown Girl Jane x Shea Moisture Grant | $10,000-$25,000 | Black & women-owned beauty businesses, 1+ years in operation | 2025 cycle TBD |

| Backing the B.A.R. Grant | $10,000 | Black entrepreneurs in beverage service industry | Application closed for 2025 |

| Santander’s Cultivate Small Business | Up to $20,000 | Food industry businesses, select cities | July 8, 2025 |

| DigitalUndivided’s Breakthrough Program | $5,000 + mentorship | Black/Latina women with $50,000+ revenue | Aug 5 - Sept 22, 2025 |

| She’s Connected by AT&T | $50,000 | Women-owned businesses with <50 employees, U.S. registered | 2025 cycle TBD |

| Google for Startups Black Founders Fund | Up to $150,000 | Black-led startups with traction | Q2 2025 (check website for dates) |

| NAACP Powershift Entrepreneur Grant | $25,000 | Black entrepreneurs, rising and established | Oct 24 - Nov 1, 2025 |

| SoGal Black Founder Startup Grant | $5,000-$10,000 | Black women/nonbinary entrepreneurs, scalable solutions | Rolling basis |

Before diving into specific grant opportunities, it’s important to understand the context of funding for Black women entrepreneurs. This knowledge will help you better position your applications and understand why specialized grants are so critical.

Despite being the fastest-growing group of entrepreneurs in the United States, Black women face significant barriers when seeking funding. The statistics paint a stark picture:

According to the Fearless Fund, businesses owned by Black women in 2022 received less than 1% of the $288 billion that venture capital firms deployed.

They are denied loans at rates 2.5 times higher than white business owners.

These disparities aren’t just numbers, but instead they represent real obstacles to growth, innovation, and wealth creation. Many Black women entrepreneurs report having to bootstrap their businesses or rely on personal savings and credit cards, which limits their ability to scale operations.

Specialized grants for Black women entrepreneurs serve as a critical counterbalance to these systemic inequities. They offer:

Non-dilutive capital: Unlike equity investments, grants don’t require giving up ownership in your business

Targeted support: Many include mentorship and resources specifically addressing challenges Black women face in business

Validation: Winning a competitive grant provides external validation that can help secure additional funding

Network access: Many grant programs connect recipients with valuable professional networks

These grants recognize both the unique challenges Black women entrepreneurs face and the tremendous economic potential they represent when properly supported.

Understanding the different sources of grant funding can help you develop a comprehensive application strategy:

Federal Grants

Typically larger award amounts ($10,000-$500,000+)

More complex application processes with strict requirements

Often focus on specific industries or social impact areas

Examples: SBA grants, USDA rural business grants

Private Foundation Grants

Award amounts vary widely ($1,000-$100,000+)

May have more flexible eligibility requirements

Often align with specific social missions or causes

Examples: Amber Grant Foundation, Galaxy Grant

Corporate Grants

Usually tied to large companies’ social responsibility initiatives

Award amounts typically range from $5,000-$50,000

May include business services, mentorship, or publicity

Examples: Verizon Small Business Digital Ready Grant, Fund Her Future Grant

Community-Based Microgrants

Smaller award amounts ($500-$5,000)

Often have simpler application processes

May be awarded monthly or quarterly

Examples: HerRise Microgrant, The Freed Fellowship

By understanding these different grant types, you can prioritize applications based on your business needs, timeline, and eligibility factors.

Read Next: Top Types of Grants: A Comprehensive Guide to Funding Opportunities

Now let’s explore the specific grant opportunities available to Black women entrepreneurs in 2025. We’ve organized them by application timeline to help you plan your grant strategy effectively.

Funding Amount: $1,000 monthly

Eligibility: Businesses must be at least 51% owned by a woman and have less than $1 million in gross revenue

Application Deadline: Last day of each month at 11:59 PM

How to Apply: HerRise website

The HerRise Microgrant program awards $1,000 each month to a women-owned business, with a focus on supporting women of color entrepreneurs. Winners are announced at the next HerSuiteSpot First Friday Mixer.

This grant provides quick monthly opportunities for funding with a relatively straightforward application process, making it ideal for entrepreneurs seeking smaller infusions of capital throughout the year.

Funding Amount: $500-$2,000

Eligibility: Black business owners with brick-and-mortar storefronts in the U.S., over 18, with 20 or fewer employees and average annual revenue under $1 million

Application Deadline: Rolling basis throughout the year

How to Apply: Wish Local Empowerment Program website

This program offers grants specifically for Black business owners as part of an initiative to combat systemic racism’s impact on Black-owned businesses. Selected businesses must join Wish Local, allowing them to sell products on the Wish e-commerce marketplace.

Beyond the grant money, this program provides access to Wish’s e-commerce platform, potentially expanding your customer base and creating new revenue streams for your brick-and-mortar business.

Funding Amount: $10,000 monthly grants; eligible for yearly $25,000 grants

Eligibility: Women-owned businesses across all industries

Application Deadline: Monthly review, with winners announced by the 23rd of the following month

How to Apply: Amber Grant website

Founded in 1998, the Amber Grant Foundation awards three $10,000 grants monthly to female entrepreneurs. Monthly winners are also eligible for one of the foundation’s yearly $25,000 grants.

With three grants awarded monthly, this program offers multiple opportunities throughout the year, and the application is relatively simple, focusing on your business idea and how you would use the grant funds.

Funding Amount: Up to $5,000 (three businesses)

Eligibility: Black-owned, U.S.-based businesses

Application Deadline: June 9, 2025

How to Apply: Pathway to Opportunity competition

The Pathway to Opportunity competition (formerly known as the National Black Business Pitch) awards grants up to $5,000 to three businesses. The program includes both an application phase and a pitch competition component.

This opportunity not only provides funding but also helps entrepreneurs refine their pitching skills. This is always a valuable asset when seeking additional funding or business partnerships in the future.

Funding Amount: $10,000

Eligibility: Active users of Verizon’s Small Business Digital Ready program

Application Deadline: June 30, 2025

How to Apply: Verizon’s Small Business Digital Ready program

Businesses that actively use Verizon’s Small Business Digital Ready program are eligible for this grant. The program particularly benefits underrepresented business owners, with 51% of platform users being women-owned businesses and 62% being Black or Hispanic-owned.

Beyond the grant money, participants gain valuable digital skills training through the required educational modules, helping strengthen their business operations in today’s increasingly digital marketplace.

Funding Amount: $3,500

Eligibility: Women and people of color who run or are planning to start a business and are U.S. residents

Application Deadline: June 30, 2025

How to Apply: Galaxy of Stars

Galaxy of Stars is a grant program run by Hidden Star, a nonprofit that helps women and minority entrepreneurs. The program is designed to provide seed funding for early-stage businesses or growth capital for established enterprises.

This grant specifically targets early-stage businesses owned by women and minorities, with a straightforward application process and a focus on supporting entrepreneurs who might otherwise struggle to access traditional funding.

Funding Amount: $500 monthly microgrant + free 60-minute business coaching session; eligible for year-end $2,500 grant

Eligibility: Small business owners, with focus on underrepresented entrepreneurs

Application Deadline: Monthly selection (rolling)

How to Apply: Freed Fellowship

Each month, the Freed Fellowship awards a small business owner a $500 microgrant and a free 60-minute business coaching session. Monthly winners are also eligible for a year-end $2,500 grant.

The combination of funding and professional coaching provides both immediate financial support and long-term business development assistance, making this program particularly valuable for entrepreneurs seeking guidance along with capital.

Funding Amount: $10,000

Eligibility: Black transgender women in the visual arts field located in the U.S.

Application Deadline: July 2, 2025

How to Apply: Illuminations Grant

The Illuminations Grant is an annual program that awards $10,000 to Black transgender women working in the visual arts field. Applicants must submit examples of their visual art as part of the application process.

This grant addresses the unique funding challenges faced by Black transgender women artists, providing substantial support for creative entrepreneurship in an often-overlooked demographic.

Funding Amount: Up to $4,000

Eligibility: NASE members in good standing

Application Deadline: Rolling (monthly awards)

How to Apply: National Association for the Self-Employed

The National Association for the Self-Employed (NASE) awards grants of up to $4,000 to help small business owners finance specific needs, such as purchasing equipment, hiring staff, or implementing marketing plans.

These grants are specifically designed to address concrete business needs with a clear growth impact, making them ideal for entrepreneurs with specific expansion or improvement projects in mind.

Funding Amount: $5,000 grants plus marketing and technology resources

Eligibility: Small businesses located in Boston, MA; Grand Rapids, MI; Nashville, TN; Seattle, WA (King County); or South Valley, UT (Wasatch Front)

Application Deadline: The application cycle closed on May 31, 2025, but it’s a recurring annual program

How to Apply: Comcast RISE grant

Comcast RISE will award approximately 500 winners with a comprehensive package including a $5,000 cash grant, business consultation services, educational resources, creative production, media schedule, and a technology makeover.

The program specifically targets small businesses in selected geographic areas, making it ideal for entrepreneurs in those regions looking for both financial support and business development resources.

Juggling multiple grant applications alongside running your business can be overwhelming! But Grantboost can be a game-changer.

Simply complete a brief survey about your organization and funding goals, and the platform generates customized grant proposal answers that incorporate proven strategies to resonate with funders.

Funding Amount: $5,000 education grant plus access to 0% interest loans

Eligibility: Women entrepreneurs who own the largest or equal stake (at least 51%) in their business, operating for 1-5 years, preferably generating at least $75,000 in revenue

Application Deadline: September 24, 2025 - November 1, 2025 (applications are closed for now, but it’s a recurring annual program)

How to Apply: Tory Burch Foundation website

While not exclusively for Black founders, the Tory Burch Foundation Fellows Program has been a significant source of funding and resources for women of color in business.

Each year, the foundation selects 50 women entrepreneurs for a yearlong fellowship that includes a $5,000 education grant, access to no-interest loans through Kiva, workshops, coaching sessions, and networking opportunities.

The program culminates with an in-person experience where fellows can present their companies and connect with industry leaders.

Funding Amount: $50,000 (first place), $10,000 (second place), $7,500 (third place), plus a $1,000 People’s Choice Award

Eligibility: At least one founder must be Black and maintain at least equal ownership stake; at least one team member must be an active NBMBAA member

Application Deadline: The application deadline for the 2025 Scale-Up Pitch Challenge is August 4, 2025.

How to Apply: NBMBAA Scale-Up Pitch Challenge website

This annual pitch competition offers Black entrepreneurs the chance to showcase their businesses to investors and industry leaders.

Beyond the substantial cash prizes, participants benefit from visibility, networking opportunities, and valuable feedback from experienced judges. The competition is designed for early-stage ideas or concepts, and all submissions must be the original work of the individual or team pitching.

Funding Amount: Up to $10,000

Eligibility: Black business owners

Application Deadline: June 9, 2025

How to Apply: National Black Business Pitch website

This annual competition selects finalists to pitch their businesses in front of a virtual audience, with three winners receiving prizes of up to $10,000. The competitive format provides not only potential funding but also valuable pitching experience and visibility.

Funding Amount: $50,000 grants; $100,000 Alumni Award

Eligibility: Black-owned beauty brands

Application Deadline: 2025 cycle to be announced

How to Apply: Glossier Grant program

The Glossier Grant program awards funding to Black-owned beauty brands. In previous cycles, businesses received grants of $50,000, with alumni awards of up to $100,000.

Beyond substantial funding, winners gain visibility within the competitive beauty industry and potential connections to larger beauty networks, providing both immediate capital and long-term industry positioning benefits.

Funding Amount: $10,000-$25,000

Eligibility: Black and women-owned beauty businesses operating for at least one year

Application Deadline: 2025 cycle to be announced

How to Apply: Shea Moisture

This collaboration between Brown Girl Jane and Shea Moisture awards grants to Black and women-owned beauty businesses. The program targets established businesses looking to scale their operations.

This opportunity provides substantial funding specifically for beauty entrepreneurs who have demonstrated initial market traction and are positioned for growth, helping bridge the gap between startup and expansion phases.

Funding Amount: $10,000

Eligibility: Black entrepreneurs who own restaurants, bars, nightclubs, lounges, or liquor stores

Application Deadline: The application cycle closed on May 24, 2025, but it’s a recurring annual program

How to Apply: Backing the B.A.R. grant

A partnership between the NAACP and Bacardi, this grant is open to Black entrepreneurs in the beverage alcohol service industry. Recent cycles awarded ten businesses $10,000 grants each.

In addition to funding, recipients receive educational support and mentorship specific to the hospitality industry, providing both financial resources and industry-specific knowledge critical for success in this competitive sector.

Funding Amount: Up to $20,000

Eligibility: Food industry businesses with at least one year in operation, located in Boston, Connecticut, Miami, Philadelphia, New York City, or Rhode Island

Application Deadline: July 8, 2025 for the fall cohort

How to Apply: Santander’s Cultivate Small Business program

This program awards funding to early-stage entrepreneurs in the food industry, with a focus on historically underserved businesses. Participants receive capital grants after completing a 12-week virtual education curriculum.

This program combines substantial funding with valuable industry-specific education and networking, making it a comprehensive support system for food entrepreneurs looking to establish sustainable businesses.

Funding Amount: $5,000 grant plus mentorship and community access

Eligibility: Black and/or Latina women with businesses registered for at least one year and generating minimum $50,000 annual revenue

Application Deadline: August 5 - September 22

How to Apply: DigitalUndivided’s Breakthrough Program

Sponsored by JPMorgan Chase’s Advancing Black Pathways, this program supports Black and Latina women entrepreneurs through funding, mentorship, and community resources.

This program provides both funding and ongoing support through mentorship and community connections, creating a holistic support system for women of color in the technology and digital business space.

Funding Amount: $50,000 grand prize

Eligibility: Woman-owned businesses with no more than 50 employees, registered in the U.S.

Application Deadline: 2025 cycle to be announced

How to Apply: She’s Connected by AT&T

Launched in 2020, this grant awards $50,000 to one grand prize winner annually. The program focuses on supporting women entrepreneurs across various industries.

This substantial grant can provide significant growth capital for women entrepreneurs, particularly those in technology-focused businesses looking to scale operations or develop new products and services.

Funding Amount: The exact funding amount for 2025 has not been specified yet. In previous years, the fund provided up to $150,000 in equity-free cash awards, along with Google Cloud credits and mentorship.

Eligibility: Black-led startups with demonstrated traction and growth potential

Application Deadline: Applications typically open in Q2 (check website for 2025 dates)

How to Apply: Google for Startups website

Google’s Black Founders Fund provides non-dilutive cash awards to Black-led startups that have demonstrated traction in their markets.

Recipients also receive Google Cloud credits, advertising support, and hands-on assistance from Google experts across product, design, and technical challenges.

Funding Amount: $25,000

Eligibility: Rising and established Black entrepreneurs and businesses

Application Deadline: Applications open October 24, 2025; close November 1, 2025

How to Apply: NAACP Powershift Entrepreneur Grant website

This grant empowers Black entrepreneurs with funding and resources. Winners receive not only financial support but also mentorship from Shark Tank’s Daymond John and the opportunity to join him during the Black Entrepreneurs broadcast event in Atlanta.

Selected applicants will be notified for final interviews by November 15, with winners needing to be available for the announcement event from November 20-22, 2025.

Funding Amount: $5,000 and $10,000 grants

Eligibility: Black women or Black nonbinary entrepreneurs with legally registered businesses, seeking investor financing, and offering scalable solutions

Application Deadline: Rolling basis

How to Apply: SoGal Foundation website

The SoGal Foundation focuses on closing the diversity gap in entrepreneurship and venture capital. Their Black Founder Startup Grant provides both funding and access to SoGal’s extensive network of investors, mentors, and fellow entrepreneurs.

Want to make your grant application process smoother? Grantboost’s Free Plan lets you access best practice templates that are perfect for small businesses just getting started.

If you’re applying for multiple opportunities, the Pro Plan at just $19.99/month gives you unlimited access to all features, helping you stay on top of your applications and increase your chances of success

While grants are valuable, they should be part of a diversified funding strategy:

The Small Business Administration offers several programs specifically beneficial to Black women entrepreneurs:

Loans up to $50,000 (average around $13,000)

Available through nonprofit community lenders

More accessible than traditional bank loans

Can be used for working capital, inventory, supplies, or equipment

SBA Community Advantage Loans:

Loans up to $350,000

Designed for underserved markets

Lower down payment requirements

Technical assistance often included

SBA 8(a) Business Development Program:

Nine-year program for disadvantaged small businesses

Access to set-aside federal contracts

Business development assistance

Mentoring and training opportunities

How to Access: Start by connecting with your local SBA office or Small Business Development Center (SBDC) for guidance on which programs best fit your needs.

CDFIs are specialized lenders focused on economic opportunity in underserved communities:

Benefits of CDFI Funding:

More flexible lending criteria than traditional banks

Often offer lower interest rates

Provide technical assistance alongside funding

Mission-aligned with supporting minority entrepreneurs

Notable CDFIs for Black Women Entrepreneurs:

Grameen America

Accion Opportunity Fund

Black Business Investment Fund

Hope Credit Union

The Runway Project

How to Apply: Research CDFIs in your area, review their lending criteria, and schedule an initial consultation to discuss your funding needs.

Crowdfunding can provide both capital and market validation:

Platform Selection:

Kickstarter/Indiegogo: Best for product-based businesses

iFundWomen: Platform specifically for women entrepreneurs

Republic: Equity crowdfunding for growth-stage businesses

GoFundMe: For community-based or social impact businesses

Keys to Successful Campaigns:

Set a realistic funding goal (typically $5,000-$25,000)

Create compelling visual content (videos increase success rates by 30%)

Offer meaningful rewards at various contribution levels

Build momentum before launch (aim for 30% funding in first 48 hours)

Engage your personal network first before broader outreach

Update supporters regularly throughout the campaign

For individuals and teams looking to secure more funding with less effort. Streamline your grant-writing process, stay organized, and achieve better results with proven templates and AI-driven support.

Now that you know what grants are available, let’s focus on how to create applications that stand out to reviewers.

Before applying for any grant, gather these essential documents:

Business Documentation:

Business registration/license

EIN (Employer Identification Number)

Business plan (executive summary, market analysis, financial projections)

Financial statements (profit & loss, balance sheet, cash flow)

Tax returns (business and personal)

Bank statements (3-6 months)

Narrative Materials:

Mission and vision statements

Founder’s biography and experience

Business history and milestones

Impact statement (how your business benefits the community)

Growth plan (how grant funds will be used)

Supporting Materials:

Product/service photos or samples

Customer testimonials

Press coverage or recognition

Industry certifications or awards

Team member bios (if applicable)

Grant reviewers read dozens, sometimes hundreds of applications. Your narrative needs to be memorable and impactful:

Tell Your Authentic Story:

Share your personal journey as a Black woman entrepreneur

Highlight challenges you’ve overcome

Connect your business to your values and purpose

Demonstrate Clear Impact:

Quantify your business impact (jobs created, customers served)

Explain how your business addresses community needs

Show how grant funding will multiply your impact

Align with the Grant’s Mission:

Research the grant provider’s values and priorities

Explicitly connect your business goals to their mission

Show how funding you advances their objectives

Example: “Investing in this specialized equipment will allow us to increase production by 40%, hire two additional employees from our underserved community, and reduce our environmental impact by 25%.”

BTW, Grantboost makes it easy to tackle grant applications. Just paste in the grant opportunity, and our AI will analyze the details, extracting the key elements and aligning them with your needs.

This ensures your responses are spot-on and tailored to each specific opportunity, so you can submit proposals that hit all the right marks with minimal effort

Read Next:

Winning Grant Application Examples to Fuel Your Proposal Success

Writing a Letter of Support for Grants: Examples and Frameworks

Grant Letter of Intent: How to Write One, Examples + Templates

Grant reviewers want to see that you have a clear, realistic plan for using funds:

Create a Specific Budget:

Break down exactly how grant funds will be used

Include quotes or estimates for major purchases

Show timeline for implementation

Demonstrate ROI:

Project the financial impact of the grant (increased revenue, reduced costs)

Show how the grant creates sustainable growth, not just a temporary boost

Include metrics you’ll use to measure success

Show Financial Management Skills:

Include current financial statements showing responsible management

Demonstrate understanding of your business financials

Be transparent about challenges and how the grant addresses them

Example Budget Breakdown:

| Expense Category | Amount | Timeline | Expected Impact |

|---|---|---|---|

| Equipment Purchase | $3,500 | Month 1 | 30% production increase |

| Marketing Campaign | $2,500 | Months 2-3 | 20% customer acquisition |

| Inventory Expansion | $2,000 | Month 1 | 4 new product lines |

| Skills Training | $1,000 | Months 1-2 | Staff efficiency +15% |

| Website Upgrade | $1,000 | Month 2 | Online sales +25% |

Before applying for grants, assess your business’s readiness using this framework:

Rate your readiness in each category from 1-5 (1=Not Started, 5=Complete & Updated):

| Documentation Type | Rating | Tips for Improvement |

|---|---|---|

| Business Registration | ___ | Ensure all licenses and permits are current |

| Business Plan | ___ | Update projections quarterly |

| Financial Statements | ___ | Have them reviewed by an accountant |

| Tax Compliance | ___ | Maintain organized records of all filings |

| Banking Records | ___ | Separate business and personal finances |

| Insurance Coverage | ___ | Review policies annually for adequacy |

| Team Documentation | ___ | Keep org chart and job descriptions updated |

Rate your ability to articulate each element from 1-5 (1=Needs Work, 5=Compelling & Clear):

| Narrative Element | Rating | Improvement Strategy |

|---|---|---|

| Founder’s Story | ___ | Connect personal journey to the business mission |

| Business Purpose | ___ | Clearly articulate the problem you’re solving |

| Community Impact | ___ | Quantify benefits to specific communities |

| Growth Vision | ___ | Create 1, 3, and 5-year projections |

| Unique Value Proposition | ___ | Differentiate from competitors |

| Use of Funds Plan | ___ | Be specific about implementation timeline |

| Success Metrics | ___ | Define how you’ll measure grant impact |

Assess your financial health in these key areas:

| Financial Indicator | Your Status | Grant-Ready Benchmark |

|---|---|---|

| Revenue Consistency | ___________ | Steady or growing for 6+ months |

| Profit Margins | ___________ | Industry-appropriate margins |

| Cash Flow Management | ___________ | Positive cash flow or clear plan |

| Debt Ratio | ___________ | Below 0.5 (total debt/total assets) |

| Financial Record-Keeping | ___________ | Organized, up-to-date books |

| Financial Projections | ___________ | Realistic forecasts with assumptions |

| Emergency Fund | ___________ | 3+ months of operating expenses |

Develop metrics to quantify your business impact:

| Impact Area | Your Metrics | How to Document |

|---|---|---|

| Job Creation | # of jobs created, salary levels | Payroll records, job descriptions |

| Community Economic Impact | $ spent with local vendors | Vendor payment records |

| Underserved Market Access | # of customers in target communities | Customer demographics data |

| Environmental Benefits | Reduced waste, energy savings | Before/after measurements |

| Industry Innovation | New products/services introduced | Product development timeline |

| Skills Development | Training provided to employees | Training logs, certifications |

| Wealth Building | Business equity growth | Valuation assessments |

For each grant opportunity, complete this worksheet:

| Grant Element | Grant Provider’s Priority | Your Business Alignment |

|---|---|---|

| Mission Focus | _____________________ | _____________________ |

| Target Beneficiaries | _____________________ | _____________________ |

| Geographic Focus | _____________________ | _____________________ |

| Industry Emphasis | _____________________ | _____________________ |

| Impact Metrics | _____________________ | _____________________ |

| Funding Priorities | _____________________ | _____________________ |

| Application Strengths | _____________________ | _____________________ |

| Potential Challenges | _____________________ | _____________________ |

Securing grants for your small business requires strategy, preparation, and persistence. As you’ve seen, there are numerous opportunities specifically designed to support Black women entrepreneurs in 2025 and beyond.

The good news? You don’t have to navigate this process alone. Grantboost’s AI-powered grant writing platform is specifically designed to help entrepreneurs create compelling grant applications in a fraction of the time.

Key Takeaways:

Diverse funding opportunities exist specifically for Black women entrepreneurs across various industries and business stages

Preparation is critical – gather essential documentation, craft a compelling narrative, and develop realistic financial projections

A strategic approach to applications increases your chances of success through careful planning and prioritization

Looking beyond grants to microloans, CDFIs, and crowdfunding creates a comprehensive funding strategy

AI tools like Grantboost can transform your application process, saving time while improving quality

Ready to transform your grant application process? Grantboost’s AI assistant can help you create compelling, compliant proposals that stand out to reviewers. Start your free trial today and see how much time you can save on your next grant application!

For individuals and teams looking to secure more funding with less effort. Streamline your grant-writing process, stay organized, and achieve better results with proven templates and AI-driven support.

Read Next: